Bellway help to buy (Review)

Bellway Help to buy

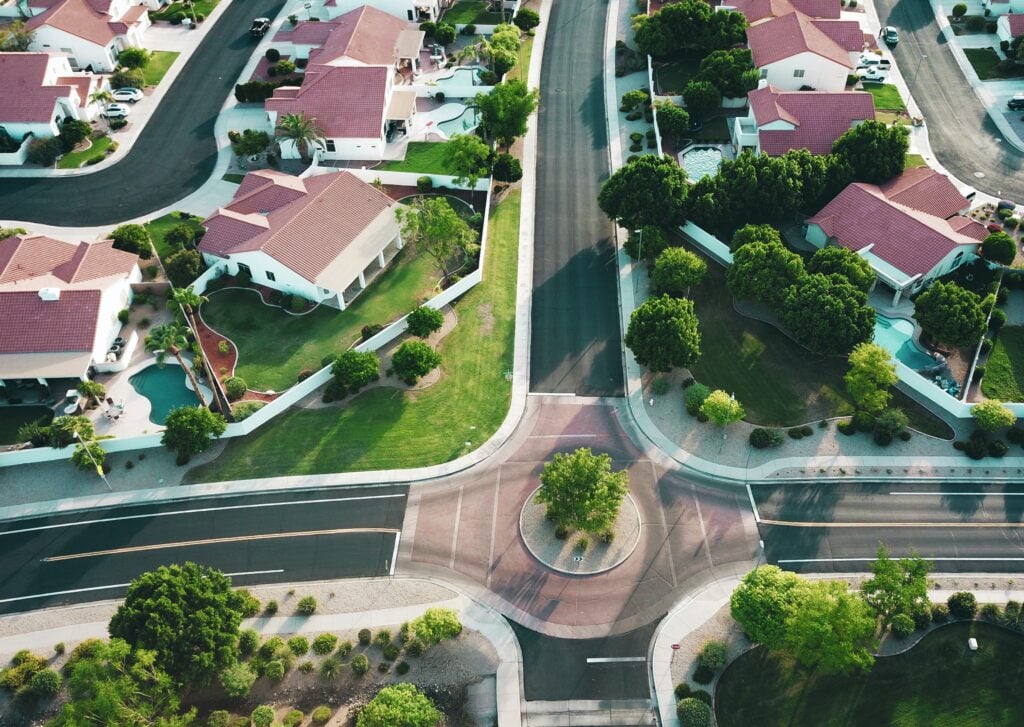

The bellway help to buy scheme refers to the first-time buyer scheme provided by the Government to help you get on the property ladder quicker. The bellway help to buy scheme refers to the properties which are eligible for the help to buy equity loan scheme with Bellway.

Bellway is a help to buy builder who receives funding from the government for its new build properties.

What is the help to buy equity loan?

With the help to buy equity loan, you will receive up to 40% of your property price towards your mortgage deposit. The loan is interest-free for 5 years after which your APR will be 1.75%.

Every year after your help to buy equity loan APR will increase by 1% plus RPI.

You will have to repay your help to buy equity loan on your bellway property after 25 years or before if you sell your property.

You can also buy the remaining shares on your bellway help to buy with a staircase mortgage. You may need to see legal advice and independent financial advice from a help to buy mortgage broker.

Bellway help to buy: A review

As with all Help to buys, there are some issues but in general, we weren’t able to find any negative review in regards to the Bellway help to buy team.

Here are some things you should watch out for with the Bellway help to buy:

- What restrictions are there on your Bellway help to buy property

- Selling your Bellway help to buy property might be very hard

- What are the conditions for staircasing on your Bellway help to buy property? Are there any costs involved?

- Is your Bellway help to buy property located amongst other housing association properties?

- What is the rate and service charge on your Bellway help to buy property and how often will it increase and by how much?

- Recap: To be eligible for Bellway help to buy properties then you will need to be eligible for the help to buy equity loan.

The help to buy eligibility requirements are:

- You must be a first-time buyer

- Have a minimum of 5% for your mortgage deposit

- You cannot purchase a buy to let property

- You cannot rent out any part of the Bellway help to buy property

- Your Bellway help to buy property cannot be more than £600,000

- You must be a first-time buyer or a home mover with no other property in the world.

- You cannot have any overdue payments on any loans, any county court judgments (CCJs) against you for more than £500 nor can you have a bankruptcy on your credit file within the last 3 years.

- You can only use a standard repayment mortgage, you won’t be able to use any unique type of mortgage such as a guarantor mortgage or offset mortgage.

- You cannot use any other Government schemes with your help to buy scheme aside from a help to buy ISA.

- You must be a UK resident

If you need financial advice and you live in the UK then you could contact the Money Advice service over the phone or via chat for impartial advice.

You can also contact the debt charity “Step Change” if you are in debt and need help.